We Provide Broad Flexibility to Our Advisor Partners

Financial advisors are the cornerstone of our business. That’s why we devote significant time and effort towards designing our service package to help them grow and retain their retirement plan business.

Defining a retirement plan standard of excellence

The retirement plan industry is evolving rapidly which means that more and more is expected from advisors who wish to successfully operate in this marketplace. For them, it’s critical to partner with a service provider that offers innovative technology and client-centric service while at the same time remaining cost-competitive.

Features

Our customers typically say it’s our high level of service that truly sets us apart. But that’s not our only redeeming quality…

Pure Open Architecture

State-of-the-Art Participant Website

Revenue Offsets

Personalized Service

Flexible Service Packages

Fee Transparency

Nothing’s hidden which makes it easier for Plan Fiduciaries to better fulfill their responsibilities to their participants.

ERISA 3(38) Services

Guided Financial Planning

Financial Wellness

Improving Retirement Outcomes

Participants Need Our Help!

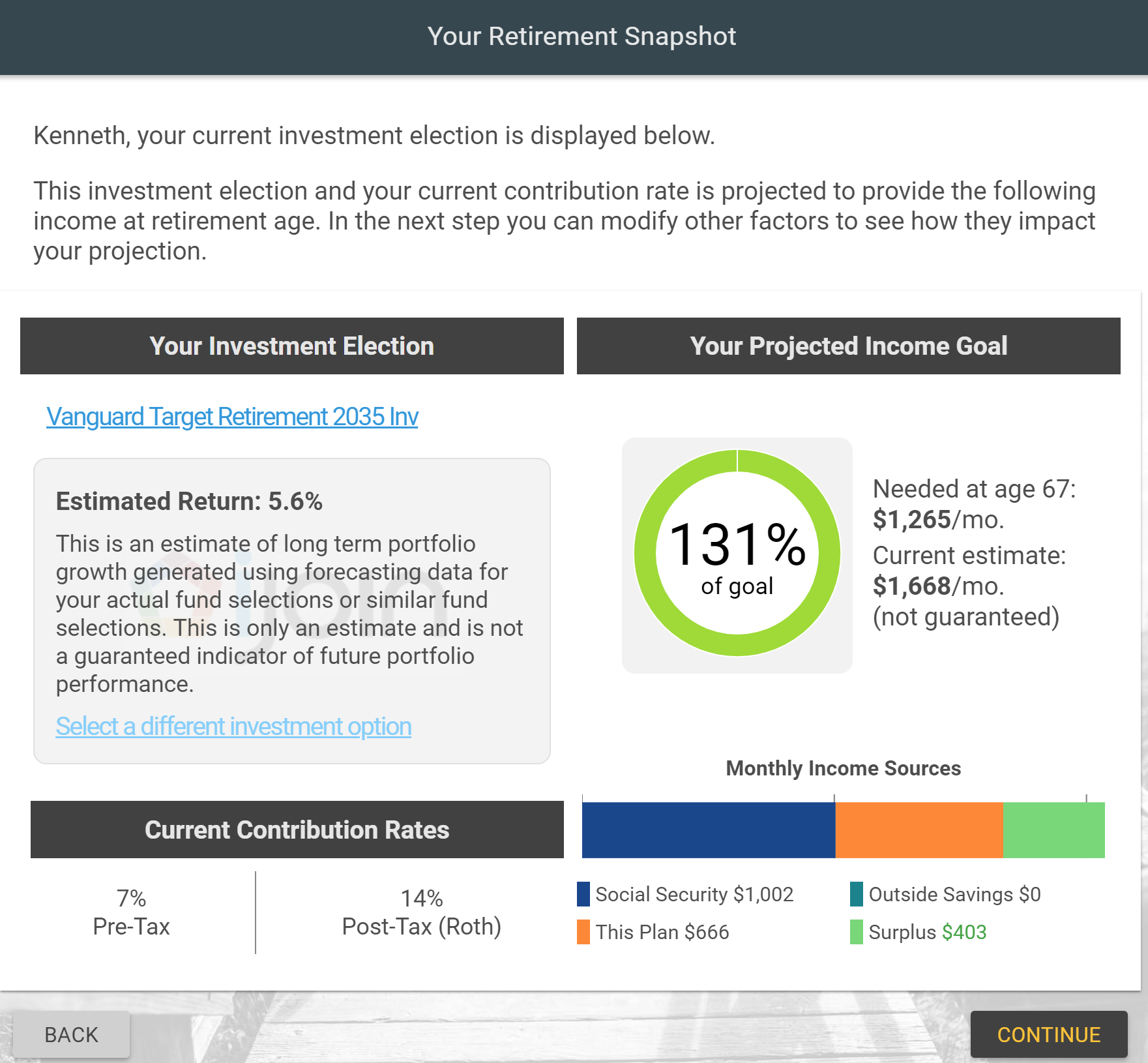

How many times have you been asked by participants “How much should I contribute?” or “Where should I invest my money?”.

The answers to those questions depend, of course, on a variety of individualized factors – participant age, current savings, investment risk tolerance, assumed rates of return on investments, anticipated retirement age and so on.

TRG offers several useful resources on our participant website to help address those common questions. From the simple to the more complex, the tools we provide are designed to appeal to a broad range of user experiences and levels of interest in an effort to motivate participants to make savings and investment decisions that will result in more positive retirement outcomes.

It Starts with a Simplified Enrollment Experience

Motivating behavior through positive visual feedback

The ideal time to positively influence participant behavior is at the point of enrollment when their motivation to take action is at the highest and they are most likely looking for answers to the common questions “How much should I save?” and “How should I invest my money?”.

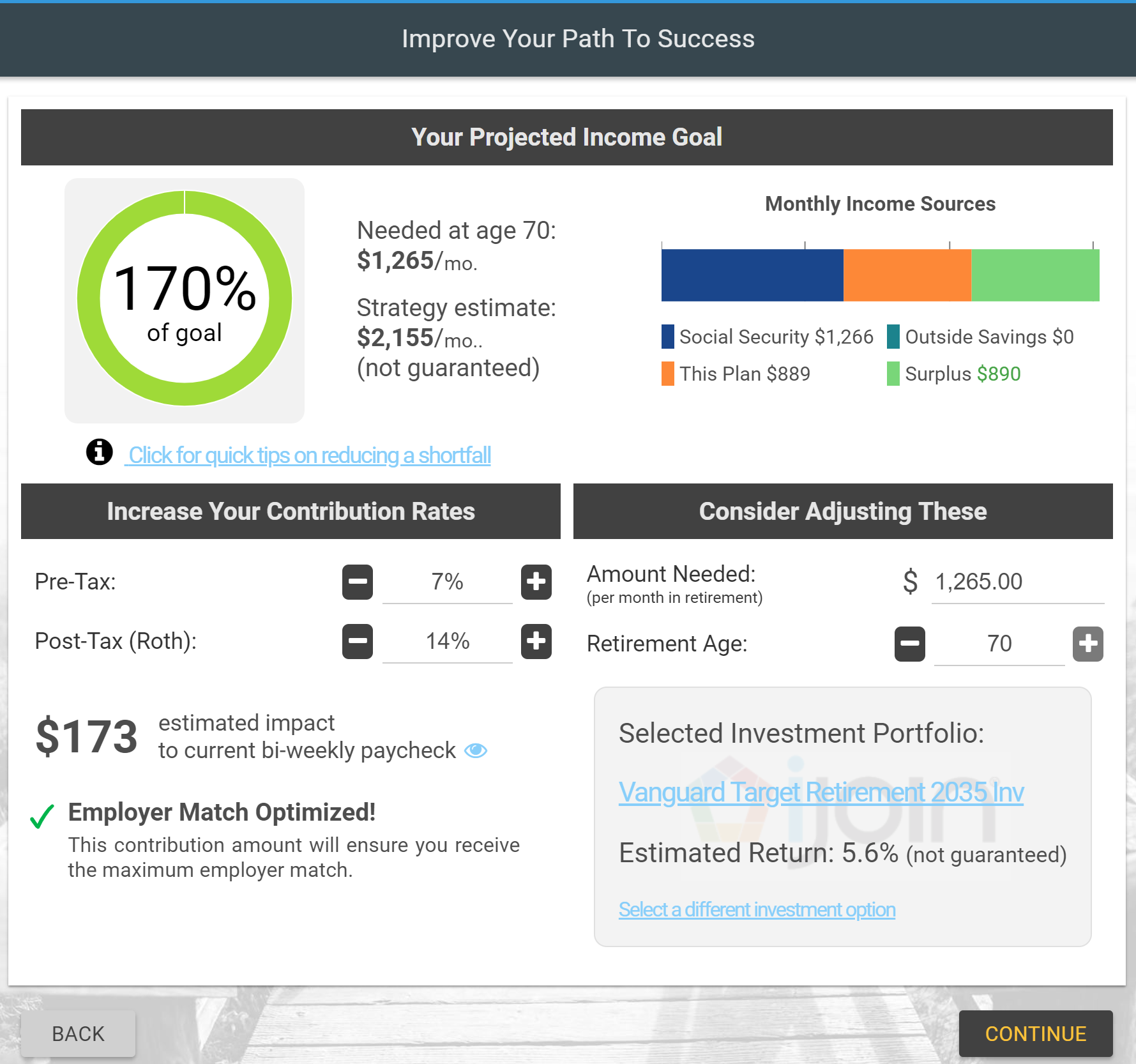

Harnessing the power of “Gamification”

TRG’s interactive enrollment immediately engages the participant as their current and suggested savings strategies are displayed in front of them. The responsive graph allows “What-if” scenarios to be played out, and changes in monthly retirement income are instantaneously reflected as the participant adjusts their contribution rate.

In the time it takes to drink a cup of coffee, participants can:

- Establish a successful saving strategy

- Detail in real time how that strategy impacts their current paycheck

- Illustrate an income stream in retirement that exceeds life expectancy

- Establish an investment allocation based on the current fund lineup and

participants risk tolerance